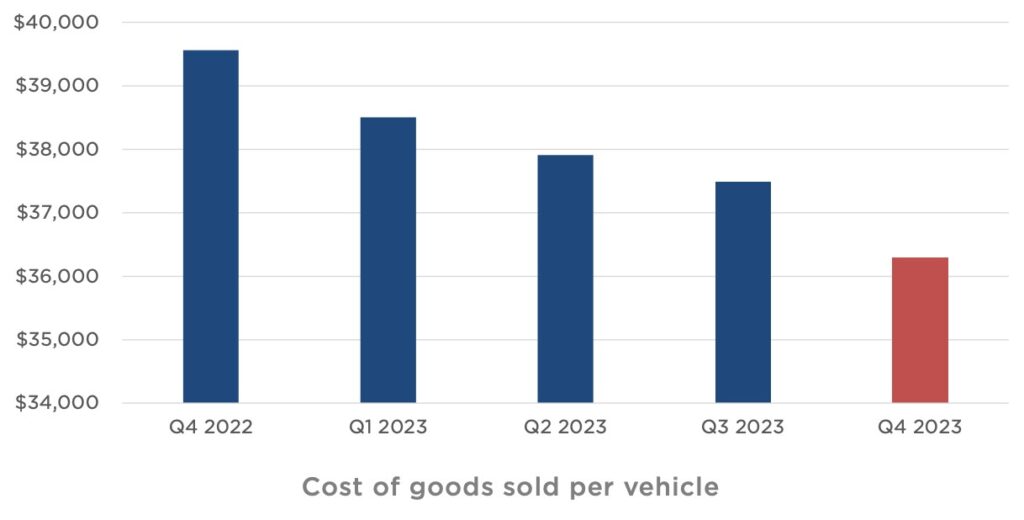

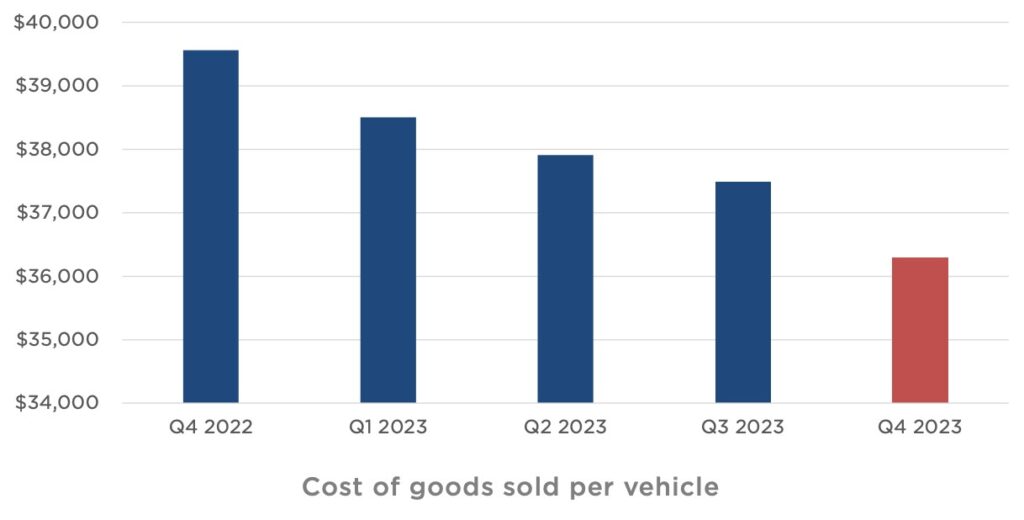

Tesla, the trailblazer in electric vehicles, has recently achieved a significant financial milestone, strategically reducing its Cost of Goods Sold (COGS) per vehicle to slightly above $36,000 in the fourth quarter of 2023.

Tesla Driving Down Costs

A Financial Breakthrough In a remarkable feat, Tesla has surpassed expectations by improving its COGS per vehicle, showcasing a sequential reduction in costs each quarter. The standout performance occurred in the fourth quarter of 2023, marked by the most substantial reduction compared to the previous quarter, as highlighted in the data since Q4 2022.

Tesla’s Financial Strategy On Vehicles

COGS, an acronym for Cost of Goods Sold, encapsulates the direct expenses associated with producing goods, covering both material costs and labor expenses in the manufacturing process. Tesla’s shareholder deck reveals a multifaceted approach, reporting, “Cost of goods sold per vehicle declined sequentially to slightly above $36,000.” Despite nearing the natural limit of cost reduction for existing vehicle models, Tesla’s team remains committed to further cost reductions across all production stages.

Strategic Vision

Growth and Investment Tesla’s strategic vision extends beyond cost reduction. The company emphasizes its commitment to growth, investing in future endeavors, and seeking additional cost efficiencies in the upcoming year. Executives, including the visionary CEO Elon Musk, have consistently detailed cost-reduction measures, echoing these sentiments during the Tesla Investor Day last year.

Understanding the Impact of Pricing

Insights from Elon Musk Elon Musk elucidates the significance of pricing in shaping consumer demand, stating, “We found that even small changes in price have a big impact on demand…very big.” Musk identifies affordability as a primary barrier to sustained growth in Tesla’s automotive sector, leading the company to leverage its next-generation platform.

Balancing Growth and Affordability

The Road Ahead While vehicle design updates can refresh Tesla’s product lineup, Musk acknowledges the pivotal role of affordability in sustaining growth. The upcoming next-generation platform is poised to introduce new, more affordable vehicles. Although this might lead to a reduction in the growth rate for the current year compared to 2023, Tesla anticipates that the innovative platform will revolutionize manufacturing processes and fortify the company’s profit margins.

Conclusion

Tesla’s adeptness in driving down costs while prioritizing growth and innovation underscores its position as a leader in the electric vehicle market. The alignment of cost-reduction measures and the introduction of a next-generation platform showcases Tesla’s commitment to staying ahead in the fiercely competitive automotive landscape.

ALSO READ :-

Tesla’s Next-Gen Vehicle Aims for Affordability, Production Set for Late 2025

FAQs

What does COGS signify in the article?

COGS, or Cost of Goods Sold, represents the direct expenses involved in manufacturing goods, covering material costs and labor expenses in production processes.

How did the fourth quarter of 2023 stand out for the company?

In Q4 2023, the company experienced a remarkable reduction in the Cost of Goods Sold (COGS) per vehicle, marking the most substantial decrease compared to the preceding quarter, showcasing an impressive financial achievement.

What is the significance of the next-generation platform mentioned in the article?

The next-generation platform holds the key to Tesla’s future growth, as it is poised to introduce more affordable vehicles. While this may affect the growth rate, it is expected to revolutionize manufacturing processes and bolster profit margins.

How has Elon Musk emphasized the role of pricing in the article?

Elon Musk underscores the impact of pricing on consumer demand, highlighting that even small changes in price can have a significant influence. This insight is crucial in the context of Tesla’s strategy to overcome affordability barriers in the automotive sector.

How does the article suggest Tesla plans to balance growth and cost-effectiveness in the coming year?

The article reveals that Tesla aims to sustain growth by investing in the next-generation platform, introducing more affordable vehicles. Simultaneously, the company remains focused on seeking additional cost efficiencies across all stages of production to maintain robust profit margins.